The stagnation of the geostationary communications satellite market was again noted at the Satellite 2023 conference, held March 13-16 in Washington, DC. But the renewed success of the European industry was also celebrated.

Lasting crisis

In a world increasingly connected to the Internet and consuming video-on-demand, the battle plans of telecom operators, who had made a living for forty years from broadcasting for television, are being turned on their heads. Over the past five years, the traditional GEO satellite market has been cut in half, with orders for new satellites at their lowest point in 2021 and 2022. And, since the beginning of 2023, no construction contract announcement has yet been made...

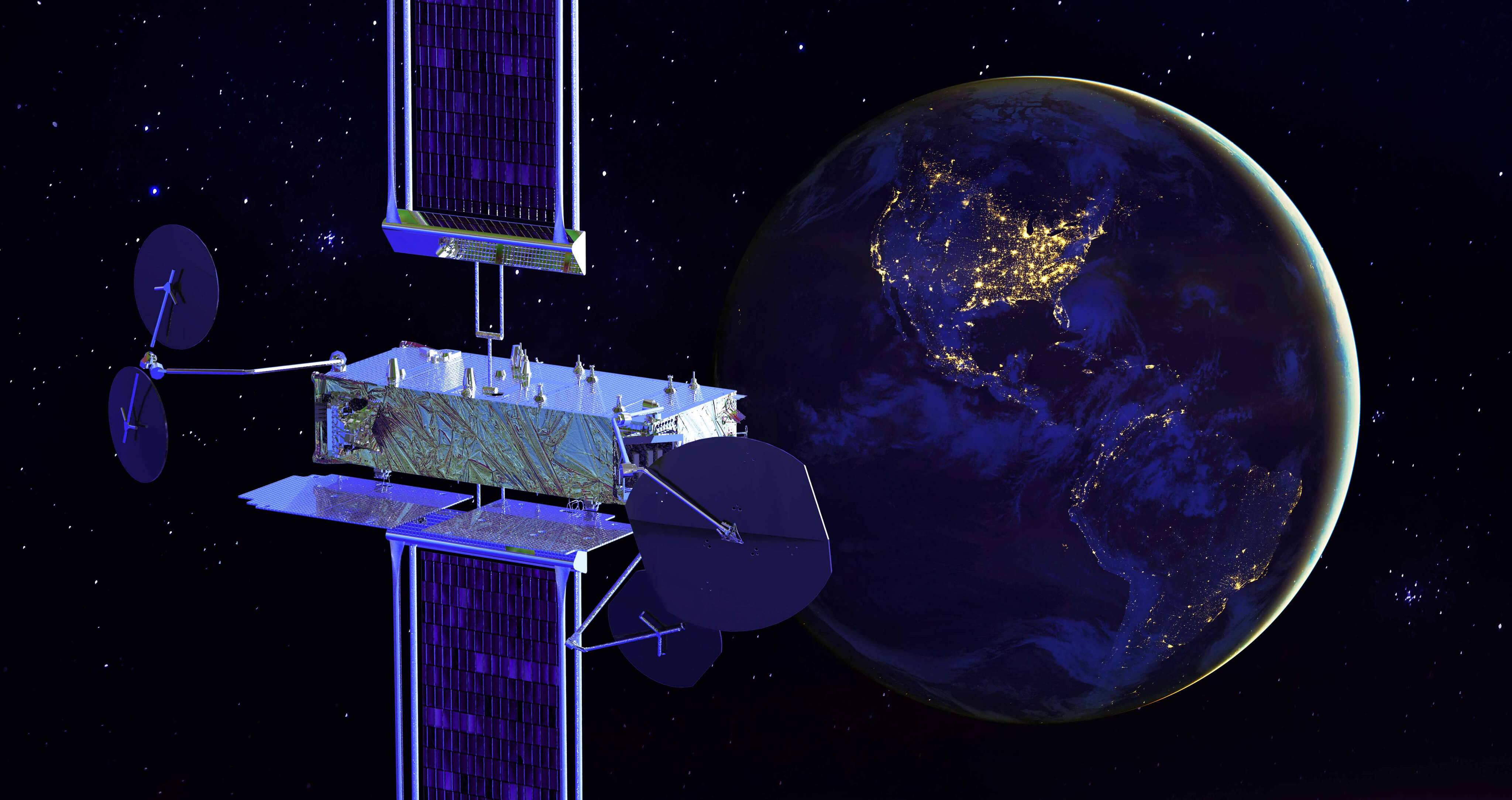

The crisis, which started in 2017 (only ten orders), is therefore proving to be lasting, despite hopes of a market revival in 2019 and 2020 (sixteen and twenty-three orders), and the arrival of new, flexible and reconfigurable telecommunication relays in orbit, notably to change geographical coverage. At the forefront of this effort are Airbus Defence and Space's OneSat and Thales Alenia Space's Space Inspire (INstant SPace In-orbit REconfiguration) digital platforms, developed with the support of the European Space Agency, Cnes and, for OneSat, the British Space Agency (Uksa). Should soon arrive from across the Atlantic competing offers, at least from Boeing Satellite Systems... but not necessarily from Maxar !

So many solutions for the renewal of operators' in-orbit capacity, technically innovative and sources of savings. For Euroconsult, which published its annual Satellites to be Built and Launched report last December, geostationary telecom satellite operator activity is expected to stabilize around thirteen orders per year by 2031. This means an annual average of $3.2 billion in manufacturing and launch value, compared with $5.3 billion for low-earth orbit constellations, which will account for 83% of all satellites expected to be launched by 2031, for 30 percent of the manufacturing and launch value. This is, for the Paris-based firm, a reflection of " the erosion of broadcasting activities and the shift to broadband activities that are intensifying but not yet compensating for the previous "

Thales Alenia Space on top of the world

For the time being, it must be said that Thales Alenia Space has remained the great champion of the GEO satcoms sector for the past two years, with the Franco-Italian manufacturer awarding itself six of the eleven 2022 contracts (including five Space Inspire), after having won five of the eleven 2021 contracts (including the first Space Inspire). While Airbus is absent from the podium in 2022, the European giant was on the second step in 2021 (two orders, including the first OneSat), ex-aequo with its competitor Maxar and newcomer Astranis (which builds small GEO satcoms), after dominating the market between 2017 and 2020 (with two peaks of six orders in 2019 and 2020).

Meeting in Washington, Marc-Henri Serre, senior vice president in charge of Thales Alenia Space's Telecommunications business, is extremely pleased with the success of his product line :" Obviously, we have to remain humble," he notes at the outset. As you have seen, the geostationary market has had its ups and downs in the past few years, and has generally stabilized at a lower level than six years ago, with ten to twelve satellites per year. [Six of our last seven orders are Space Inspire satellites: two SES (25 and 26), two Intelsat (41 and 44), one Eutelsat (Flexsat) and one Arabsat (7A), the first regional operator - and not the least - to order a reconfigurable satellite. It's very positive to have the three largest operators in the world and a regional operator like Arabsat trust our technology and invest in our product. However, we try not to rest on our laurels. If you take a step back and look at the Spacebus 4000, it's a product that dates back to the 2000s, that we developed in the 2010s, and we continue to sell it today. When we developed the Spacebus Neo, from 2013-2014, we clearly did not have in mind that we would announce in 2019 the development of the Space Inspire product even before the launch of the first Spacebus Neo! The main reason was the collapsing GEO telecom market, doubts about the evolution of demand for connectivity and broadcast, customers' wait-and-see attitude regarding their investments, questioning of business models, competition with terrestrial technologies, needs for cost reduction and flexibility. And here, at least in the field of telecoms from space, we have never seen such a strong acceleration of the innovation cycle, accompanied by the space agencies. But we were forced to make this investment, because our outlets are essentially based on the open commercial market, whereas our American competitors seem to benefit from a very strong domestic military market. It's paying off today, and should take us through the late 2020s/early 2030s... "

Three product lines

The hope for Thales Alenia Space is now to sell four Space Inspire a year, with each GEO satcom won providing 400 people with jobs for three years. This remains a challenge," admits Marc-Henri Serre. We have commercial business, for sure, on which we are actively working. We estimate that flexible satellites will represent about two-thirds of the commercial market. At Thales Alenia Space, our other products are the all-electric Spacebus Neo, but also our Spacebus-4000 chemical satellite, which continues to be a success, with four sold in the last three years two to SES, one to Telkomsat and one to KT Sat. "

Découvrez cet article sur Air&Cosmos