Less than two weeks after UTC bought Rockwell Collins, Northrop Grumman is to acquire Orbital ATK for approximately $7.8bn in cash, plus the assumption of $1.4bn in net debt.

Northrop Grumman and Orbital ATK have entered into a definitive agreement under which Northrop Grumman will acquire Orbital ATK for approximately $7.8bn in cash, plus the assumption of $1.4bn in net debt. Orbital ATK shareholders will receive all-cash consideration of $134.50 per share.

The agreement has been approved unanimously by the Boards of Directors of both companies. The transaction is expected to close in the first half of 2018 and is subject to customary closing conditions, including regulatory and Orbital ATK shareholder approval.

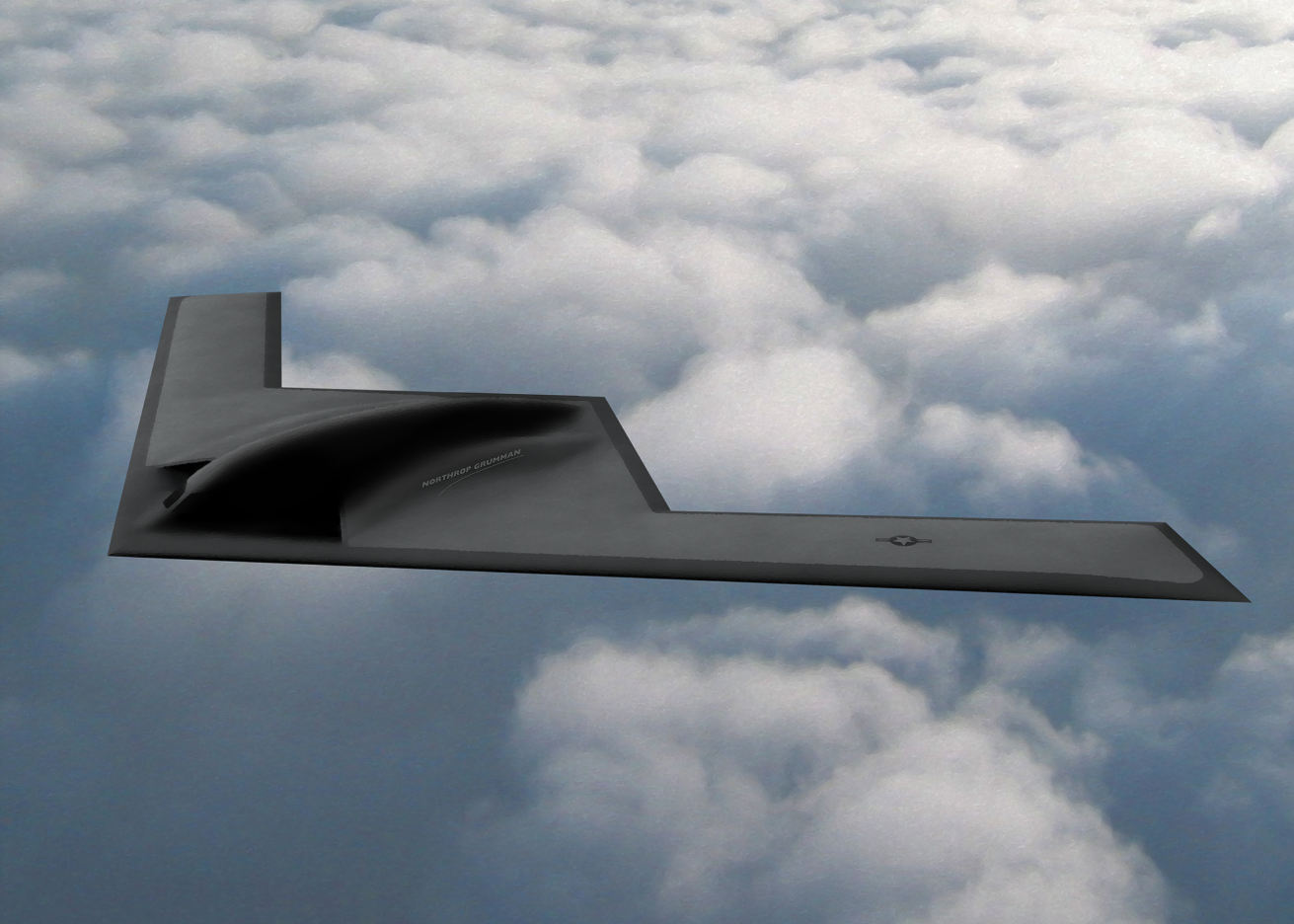

The deal — coming hard on the heels of the acquisition of Rockwell Collins by United Technologies — brings together the prime contractor for the next-generation B-21 Raider strategic bomber and the company that supplies the solid rocket motor boosters for NASA’s future Space Launch System (SLS). ATK Orbital’s Missile Products division also supplies propulsion systems for tactical missiles and missile defence interceptors and is involved in research into hypersonic missiles.

Analysts said the combination could strengthen Northrop Grumman’s position in the competition to replace U.S. land-based ICBMs.

Northrop Grumman says it plans to establish Orbital ATK as a new, fourth business sector alongside its three existing business areas: Aerospace Systems, Mission Systems and Technology Services. On a pro forma 2017 basis, Northrop Grumman expects to have sales in the range of $29.5 to $30bn based on current guidance.