The European Commission has cleared under the EU Merger Regulation the proposed acquisition of aircraft engine components maker ITP (Spain) by aircraft engine maker Rolls-Royce (UK). The decision is conditional on Rolls-Royce eliminating a conflict of interest concerning the EPI engine consortium.

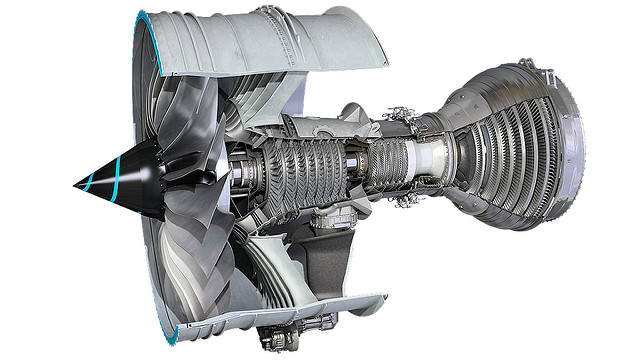

ITP (Industria de Turbo Propulsores) was created in 1989 as a joint venture between Rolls-Royce (46.9%) and Sener (53.1%). The U.K. firm announced in July last year that it planned to acquire full ownership of the venture.

Rolls-Royce, together with ITP, MTU (Germany) and Safran (France), is a member of the EPI (Europrop International GmbH) consortium. EPI designs and manufactures the engine the A400M airlifter, which competes with the Lockheed Martin C-130J, powered by Rolls-Royce AE2100 D3 engines.

The Commission had concerns that the transaction, as originally notified, would have enabled Rolls-Royce, by acquiring ITP, to obtain additional influence on the decision-making process of the EPI consortium, on matters that affect its competitiveness against the Lockheed Martin C-130J.

In order to remove these concerns, Rolls-Royce offered commitments in relation to the EPI governance rules that will eliminate the conflict of interest created by the merger and ensure that the EPI consortium remains competitive.

The Commission also investigated whether the relationship between ITP and Rolls-Royce raised competition concerns. In particular, the Commission examined whether the merged entity would have the ability and incentive to shut out the supply of ITP's engine components to other manufacturers of aircraft engines competing with Rolls-Royce. However, the Commission concluded that, after the merger, Rolls-Royce would have neither the ability nor the incentive to do so.

The Commission concluded that the transaction, as modified by the commitments, would no longer raise competition concerns. The decision is conditional upon full compliance by Rolls-Royce with its commitments.